Nigeria’s foreign exchange reserves surged to $41 billion on August 19, 2025, their highest level in 44 months, according to figures from the Central Bank of Nigeria (CBN).

This milestone, last recorded on December 3, 2021, signals a remarkable turnaround for the economy after years of pressure from external debt repayments. With this increase, the reserves can now cover approximately 10 months of imports, enhancing the CBN’s ability to stabilize the naira, manage liquidity, and curb speculative attacks on the currency.

The sustained rise in external buffers has been linked to improved forex inflows, stronger oil revenues, reduced import demand, and government-led reforms. According to CBN data, reserves have grown by $1.46 billion month-to-date, moving from $39.54 billion on August 1 to $41 billion by August 19, representing a 3.69% increase in less than three weeks.

The upward momentum began when reserves crossed the $40 billion mark on August 7, after closing July just below $39.4 billion. Analysts attribute this trend to consistent inflows outpacing outflows, a sign of renewed investor confidence.

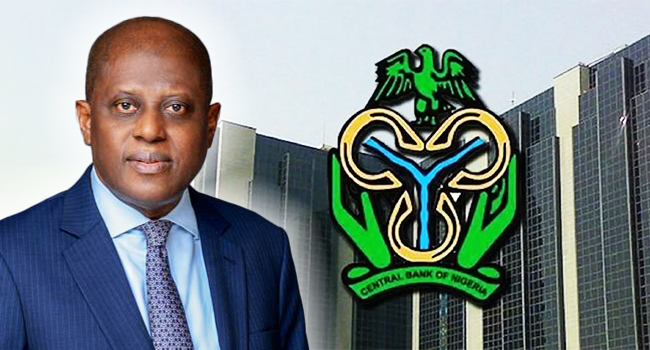

CBN Governor Olayemi Cardoso said the rally reflects improved fundamentals, citing higher capital inflows, better oil production, rising non-oil exports, and reduced imports. He emphasized the regulator’s commitment to maintaining resilience and compliance to sustain investor trust.

Despite the sharp gains in August, year-to-date growth remains modest. Reserves stood at $40.88 billion in December 2024, indicating a marginal increase of $124 million (0.30%) since the start of the year. Most of the growth occurred in the past five weeks, with reserves up over $3 billion (8%) since July.

Economists say stronger reserves could boost Nigeria’s credit outlook, reassure global investors of its ability to meet foreign obligations, and provide the CBN with capacity to manage liquidity shocks. Combined with declining inflation and naira stability, the development points to a more favorable macroeconomic environment if reforms and inflows persist.