The Central Bank of Nigeria (CBN) has cautioned that the country remains vulnerable to inflationary and financial risks despite recent signs of easing price pressures.

In the run-up to next week’s Monetary Policy Committee (MPC) meeting, the apex bank stressed the need for more market-based instruments to strengthen policy transmission and attract investments.

The CBN, which maintained a tight monetary stance at its July meeting, said the pace of disinflation remains too slow to justify any easing.

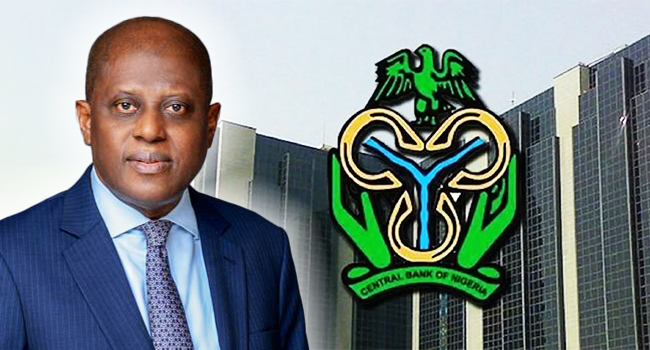

In personal statements by MPC members, seen by Daily Sun on Tuesday, Governor Olayemi Cardoso explained that the bank is reviewing its liquidity management framework to safeguard monetary stability while avoiding distortions in the market.

“The sustained stabilization of monetary conditions naturally calls for a review of our approach to the implementation of our policy stance and the liquidity management framework to ensure effective monetary policy transmission,” Cardoso stated.

He added that there is growing evidence of the need to adopt more market-based instruments to support the development of the yield curve, promote savings, and enhance financial system stability.

According to him, the availability of such tools will be crucial in managing the transition away from a high reserve requirement environment without creating market distortions.