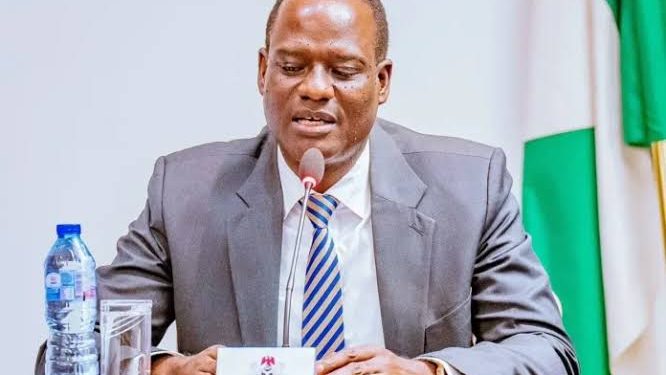

The Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Mr. Taiwo Oyedele, has announced that Nigeria’s new tax laws will provide several reliefs and exemptions aimed at supporting low-income earners, average taxpayers, and small businesses, beginning January 2026.

Oyedele disclosed that the reforms would introduce about 50 tax exemptions and reliefs designed to benefit the masses and stimulate economic activity.

He explained that under the new tax framework, pension funds and assets governed by the Pension Reform Act (PRA) would remain tax-exempt, including all pension, gratuity, or retirement benefits granted in accordance with the Act.

Furthermore, compensation for loss of employment up to ₦50 million will not be subject to taxation, providing relief for individuals facing career transitions.

Oyedele also highlighted changes under the Capital Gains Tax (CGT), noting that the sale of an owner-occupied house and personal effects or chattels worth up to ₦5 million would be exempt from CGT.

Other exemptions include:

- Sale of two private vehicles per year.

- Gains on shares below ₦150 million per year, or up to ₦10 million.

- Pension funds, charities, and non-commercial religious institutions.

- Gains on shares above the exemption threshold, if the proceeds are reinvested.

According to Oyedele, the reforms are part of a broader effort to simplify Nigeria’s tax system, encourage compliance, and ensure that the tax burden does not fall disproportionately on individuals and small enterprises.