As part of its ongoing fiscal policy reforms to ease the burden on low-income earners and enhance business competitiveness, the Presidential Fiscal Policy and Tax Reforms Committee has announced 50 new tax exemptions and reliefs set to take effect from January 1, 2026.

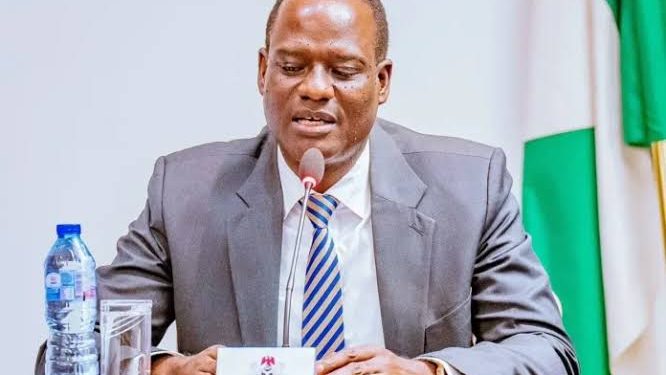

The Committee Chair, Mr. Taiwo Oyedele, disclosed the details on his official X (formerly Twitter) handle, explaining that the measures form a key component of the government’s agenda to promote inclusive economic growth, reduce inequality, and stimulate job creation across critical sectors.

According to Oyedele, the new tax reform laws will restructure Nigeria’s tax regime to favour low- and middle-income earners, micro, small, and medium-scale enterprises (MSMEs), startups, and key sectors including agriculture, manufacturing, and technology.

Under the new provisions, individuals earning the national minimum wage or less will be fully exempted from paying Personal Income Tax (PAYE). Similarly, annual gross incomes of up to ₦1.2 million, translating to a taxable income of about ₦800,000, will attract no tax.

The reforms also introduce a progressive PAYE structure, reducing tax obligations for individuals earning up to ₦20 million annually, while ensuring higher-income earners contribute more equitably to public revenue.

Oyedele noted that the reforms are designed to simplify tax compliance, expand the tax net through fairness, and align Nigeria’s fiscal system with global best practices.

The Federal Government has described the initiative as a milestone in the country’s journey toward a fairer, growth-oriented tax regime that prioritises citizens’ welfare and business sustainability.