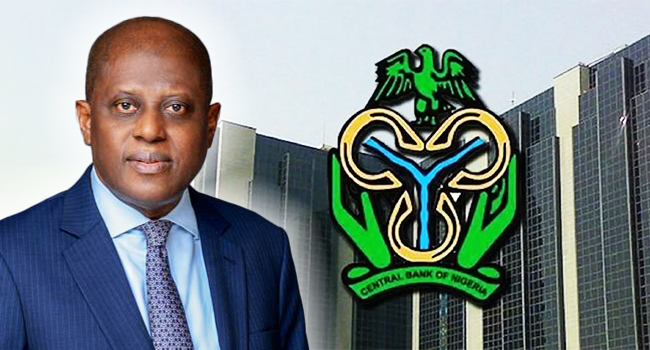

The Central Bank of Nigeria (CBN) yesterday voted to retain the Monetary Policy Rate (MPR) at 27%, emphasizing the need to allow the effects of previous monetary easing to fully filter through the economy.

CBN Governor Olayemi Cardoso, speaking at the final Monetary Policy Committee (MPC) meeting of the year in Abuja, also disclosed that 16 banks have met the new minimum capital requirements, while 27 banks have raised capital under the recapitalisation mandate.

Cardoso revealed that the apex bank has recovered ₦2 trillion of intervention funds in the last two years, though ₦4.69 trillion remains outstanding.

According to him, “The committee decided by a majority vote to maintain the current monetary policy stance with an adjustment to the corridor as follows: Retain the MPR at 27%; adjust the standing facility corridor around the MPR at +50 to –450 basis points.”

The MPC also retained the Cash Reserve Ratio (CRR) at 45% for Deposit Money Banks, 16% for merchant banks, and 75% for non-TSA public sector deposits, while the liquidity ratio remained unchanged at 30%.

Cardoso said the decision was guided by the need to sustain progress toward low and stable inflation, noting seven consecutive months of year-on-year inflation deceleration. He attributed the improvement to tighter monetary policy, stable exchange rates, increased capital flows, a surplus current account balance, and improved food supply.

However, he stressed that inflation remains elevated, requiring continued vigilance:

“The steady deceleration in inflation across headline, core and food in October 2025 suggests that previous tight policy measures will continue to transmit into the economy. Maintaining the current stance amidst global uncertainties allows these effects to fully materialise.”

Cardoso highlighted that the bank cannot embark on new intervention programmes due to the huge outstanding liabilities from past interventions.

He explained:

“Total intervention amounted to about ₦10.93 trillion since around 2010–2013. Of this, ₦4.69 trillion is still outstanding—about 43%. We have recovered ₦2 trillion since assuming office. This is a humongous amount of money.”

Reacting to the decision, Lukman Otunuga, Market Analyst at FXTM, said many analysts anticipated a rate cut of at least 50 basis points given inflation’s movement toward the government’s 15% year-end target.

He noted that such a cut could have spurred economic activity by easing borrowing costs and boosting investment. However, the MPC opted for caution, reinforcing its data-dependent approach.

Otunuga added that signs of sustained cooling in price pressures could pave the way for a possible rate cut in 2026.