The Central Bank of Nigeria (CBN) has decided to maintain all key monetary policy parameters, including the Monetary Policy Rate (MPR), at their current levels in a bid to sustain Nigeria’s disinflation momentum and manage inflationary pressures.

Following its two-day Monetary Policy Committee (MPC) meeting, the apex bank on Tuesday announced that the MPR would remain at 27.5%, with the asymmetric corridor held at +500/-100 basis points.

The Cash Reserve Ratio (CRR) for Deposit Money Banks was also retained at 50%, while Merchant Banks’ CRR stayed at 16%, and the Liquidity Ratio remained unchanged at 30%.

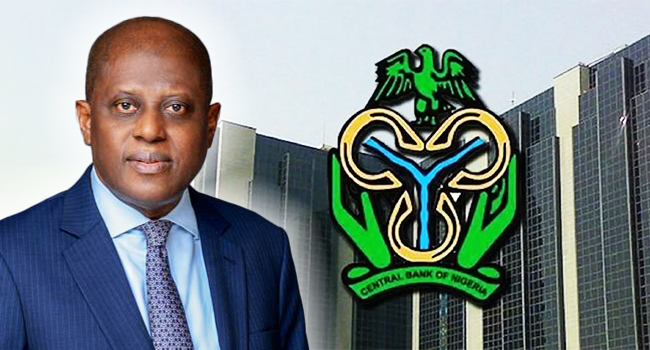

Speaking at a press briefing in Abuja, CBN Governor Olayemi Cardoso said the unanimous decision to hold policy was informed by the need to maintain the pace of disinflation and address persistent price pressures.

“Maintaining the current policy stance will continue to address the existing and emerging inflationary pressure,” Cardoso stated.

He emphasized that the MPC would continue to conduct rigorous assessments of economic conditions, monitor price developments, and review macroeconomic outlooks to inform future policy decisions.

The decision signals a cautious approach by the CBN as it balances the need for price stability with economic growth targets amid fluctuating global and domestic economic conditions.