THE Federal Government has proposed to grant tax relief to companies that donated to the COVID-19 relief fund under the private sector coalition, CACOVID. The government also has proposed exemption of small companies from payment of education tax under the Tertiary Education Trust fund, TETFUND-companies with less than N25 million turnover are eligible.

his is as the government yesterday presented the Finance Bill 2020 which was approved by the Federal Executive Council, FEC, to the National Economic Council, NEC. The government further gave reasons why food stuffs are soaring.

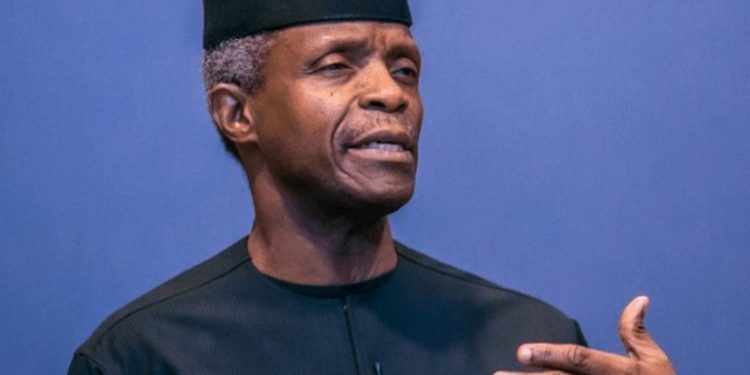

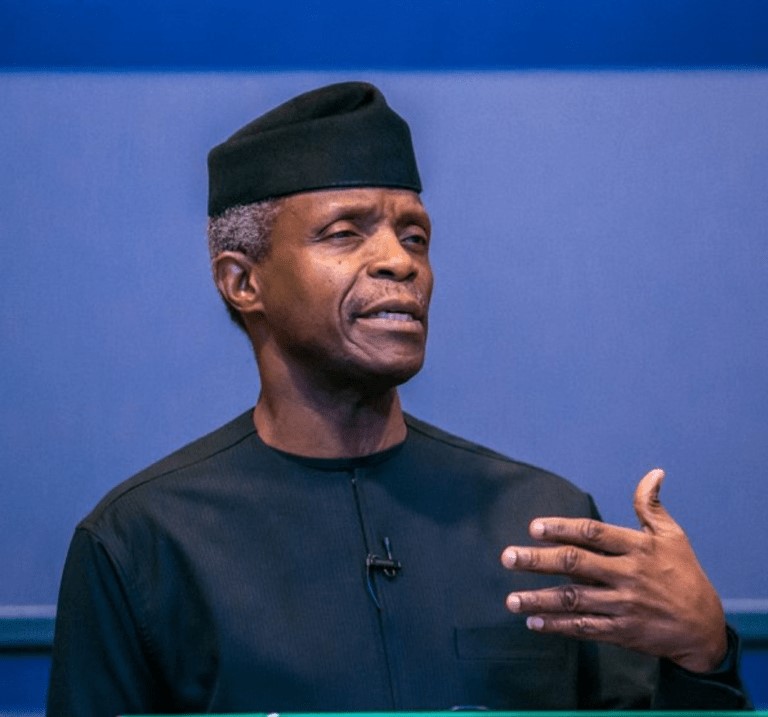

The approved Finance Bill 2020 that was presented to the governors is seeking to provide more tax incentives for Nigerian businesses and individuals. This was contained in a statement issued by the Senior Special Assistant to the President on Media and Publicity, Office of the Vice President, Laolu Akande, at the end of the virtual NEC meeting presided over by Vice President Yemi Osinbajo, at the Presidential Villa, Abuja.

Some highlights of the proposed bill which is being sent to the National Assembly include: “Reduction in duties on tractors from 35 to 10 percent, reduction in duties on motor vehicles for the transportation of goods from 35 to 10 per cent, reduction of levy on motor vehicles for the transportation of persons (cars) from 35 per cent to 5 per cent.

“Exemption of small companies from payment of education tax under the Tertiary Education Trust fund (TETFUND)-companies with less than N25m turnover are eligible “50 percent reduction in minimum tax; from 0.5 percent to 0.25 per cent for gross turnover for financial years ending between January 1, 2020 and December 31, 2021. “Granting of tax relief to companies that donated to the COVID-19 relief fund under the private sector coalition (CACOVID). “Clarification that only compensation for loss of office up to N10million would be tax exempt. (Clarification that it is the employer’s obligation to account for tax on payments relating to compensation for loss of office.) “Introduction of software acquisition as qualifying capital expenditure to improve the ease of doing business.”

The statement further said, “Minister of State for Budget and National Planning, Clem Agba made presentation at the virtual NEC meeting for the month of November 2020. “Prior to the Finance Act 2019, compensation paid to an employee for loss of office over and above N10, 000 was subject to capital gains tax. There were two notable issues with the provision.”

Akande said the Minister reported to council that the balance of Excess Crude Account ECA as at 17th November, 2020 was at $72,409,970.48 The Stabilization Account balance was N49, 151,181,622.35, while the Natural Resources Development Fund Account balance was N155, 530,778,234.58 The statement stated that the committee chaired by the Vice President to engage with youths and other critical stakeholders in addressing the deeper roots of the #EndSARs protests which was formed at the last NEC presented its report.

The committee is made up of governors drawn from the six geopolitical zones in the country. They are, Aminu Waziri Tambuwal, Sokoto State Governor representing northwest; Prof. Babagana Umara Zulum, Borno State Governor representing northeast; Abubakar Sani Bello, Niger State Governor representing northcentral; Rotimi Akeredolu, Ondo State Governor representing southwest; Engr. Dave Umahi, Ebonyi State Governor representing southeast; and Dr. Ifeanyi Okowa, Delta State Governor representing southsouth.

The Committee was mandated to engage the youth, religious organization, civil society, security agencies regarding the issues and recommend effective solutions towards strengthening national unity among others. Some of the resolutions of the committee as presented by its Chairman included two broad levels of engagement, one with state and the second with zonal levels. It was resolved that the Governors should commence engagement within a week and to develop guidelines of engagement process.

ource: Vanguard News