The Federal Government has clarified that there is no immediate plan to implement the controversial 5% fuel tax, despite its inclusion in the new Tax Administration Act set to take effect on January 1, 2026.

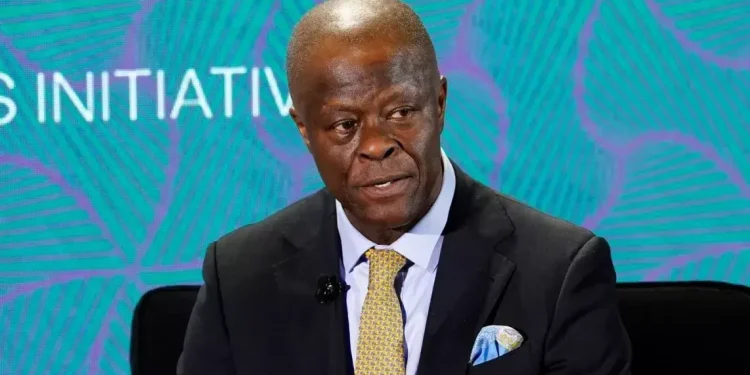

This reassurance came on Tuesday from the Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, and Chairman of the Presidential Committee on Fiscal Policy and Tax Reforms, Mr. Taiwo Oyedele, during a press briefing in Abuja.

Their comments follow mounting public anxiety and a 14-day ultimatum issued on Monday by the Trade Union Congress of Nigeria (TUC), warning the federal government to reconsider any fuel tax plans or face nationwide protests and a potential economic shutdown.

“Let me re-emphasise and underscore the following: The tax reform bills and the tax act will not become operational until January 1, 2026, and the 5% fuel surcharge mentioned therein will not automatically come into effect,” Edun stated.

He explained that while the Tax Administration Act is part of a broader legislative framework to boost transparency, modernise revenue collection, and simplify compliance, implementation of specific provisions—like the fuel surcharge—would be subject to further review and consultation.

Oyedele also echoed these sentiments, stating that the government is mindful of the current economic hardship facing citizens and is committed to fair, inclusive tax reform.

The assurance comes at a critical time as households and businesses continue to grapple with high inflation, rising energy costs, and increased cost of living.

The government reiterated its commitment to responsible and phased tax policy reforms that will not impose undue burden on Nigerians.