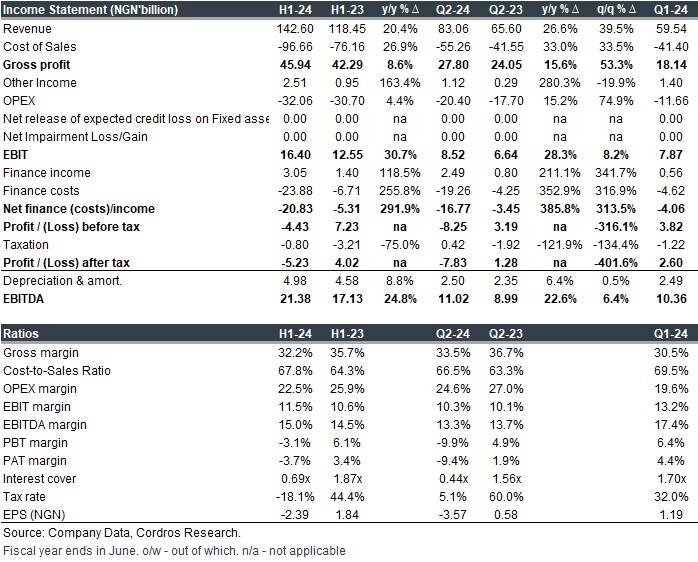

Guinness Nigeria Plc (GUINNESS) has published its unaudited Q2-24 results, revealing a standalone loss per share of NGN3.57 (compared to an EPS of NGN0.58 in Q2-23), leading to a loss per share of NGN2.39 in H1-24 (H1-23 EPS: NGN1.84). The negative earnings outcome primarily resulted from a significant increase in net finance costs, which rose by 385.8% year-on-year (y/y).

In Q2-24, GUINNESS achieved a robust 26.6% y/y increase in revenue (H1-24: +20.4% y/y). This growth was underpinned by higher prices in key categories like Stout, Ready-to-Serve, and Mainstream Spirits. Additionally, an improved product mix on premiumization contributed to the positive revenue trend. On a quarter-on-quarter basis, revenue saw a substantial 39.5% increase, driven by festive-induced demand and increased sales from on-trade channels.

Despite the strong revenue growth, the gross profit margin contracted by 319 basis points y/y to 33.5% (H1-24: -349 bps y/y to 32.2%). This contraction was attributed to a higher cost of sales, rising by 33.0% y/y, influenced by macroeconomic challenges such as inflation, currency depreciation, and FX market illiquidity. Consequently, the EBITDA margin also contracted by 44 bps y/y to 13.3% amid higher operating expenses (+15.2% y/y).

Further contributing to the challenging financial performance, net finance costs maintained an upward trend, surging by 385.8% y/y in Q2-24. The significant increase was primarily driven by a 325.9% y/y surge in finance costs, attributed to a rise in accrued interest expenses (+245.0% y/y) and foreign exchange losses (+247.1% y/y). Despite the rise in finance costs, GUINNESS managed to reduce its total borrowings slightly, with total borrowings decreasing by 5.3% year-to-date to NGN60.35 billion.

GUINNESS reported a pretax loss of NGN8.25 billion compared to a profit before tax (PBT) of NGN3.19 billion in Q2-23. Following a tax credit of NGN420.23 million in the quarter (versus a tax expense of NGN1.92 billion in Q2-23), the loss after tax settled at NGN7.83 billion (compared to a profit after tax of NGN1.28 billion in Q2-23).

While GUINNESS showcased strength in revenue growth, the substantial increase in finance costs, mainly due to FX losses, impacted earnings.

Analysts at Cordross Capital say sustained revenue growth is anticipated, driven by premiumization and a favorable price/volume mix looking ahead. However, the brewer faces significant FX volatility risk, leading to a decision to halt the importation of Diageo Premium Spirits. Estimates are currently under review.