Global stock markets traded within a tight range on Wednesday as investors held off on new bets ahead of key June payrolls data due from the US on Thursday.

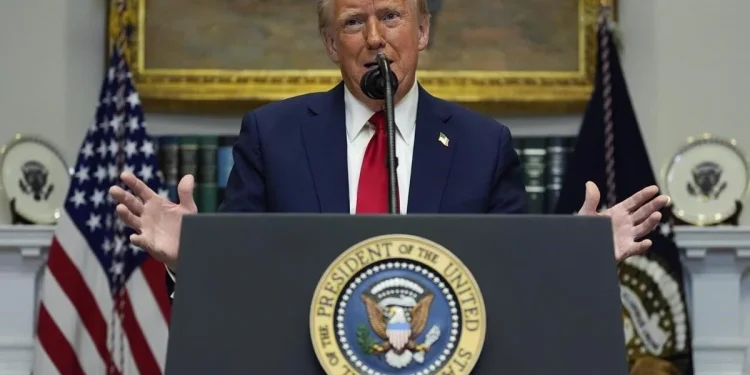

While contracts for the S&P 500 gained a modest 0.3%, an index of Asian shares was flat, paring earlier losses. In Japan, the Nikkei-225 Stock Average slipped 0.2% after former President Donald Trump issued a fresh tariff threat targeting Japanese imports and criticized the country’s resistance to US rice exports.

The US dollar index edged closer to a three-year low, reflecting caution across currency markets as trade rhetoric escalated.

Trump reaffirmed that he would not delay the July 9 deadline to raise tariffs on certain trading partners, despite market speculation that he may eventually back down.

“We are locked firmly in wait-and-see mode ahead of the jobs data,” said Tony Sycamore, market strategist at IG Australia Pte.

Despite the uncertainty, equity indexes remain near all-time highs, as investors grow accustomed to Trump’s negotiation tactics — threatening tariffs before walking them back.

The next 48 hours are expected to be crucial, as US jobs data will offer deeper insight into the health of the economy and shape expectations around the Federal Reserve’s monetary policy stance.