The Federal Inland Revenue Service (FIRS) and the Kingdom of the Netherlands have officially begun the renegotiation of the Double Taxation Agreement (DTA) between both countries, marking a significant milestone in Nigeria’s evolving international tax landscape.

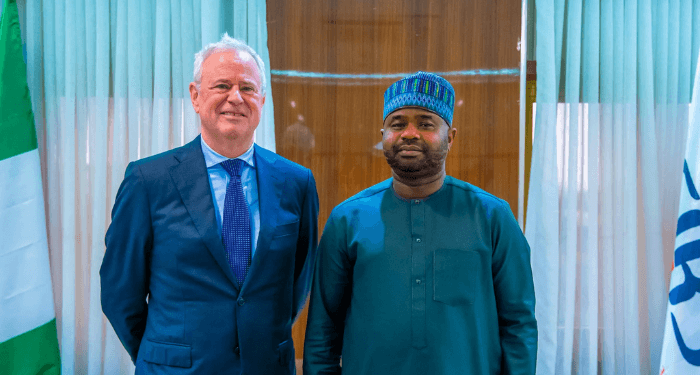

The renegotiation commenced at an event held at the Revenue House in Abuja, where FIRS Executive Chairman, Dr. Zacch Adedeji, hosted the Dutch delegation led by Ambassador Bengt van Loosdrecht.

In a statement released Monday, the FIRS described the move as the start of a new era in Nigeria’s international tax relations, driven by recent legal reforms aimed at modernising the nation’s tax framework.

This development follows the signing of the Tax Reform Bills into law by President Bola Tinubu in June 2025. The new laws include:

- The Nigeria Tax Act

- The Nigeria Tax Administration Act

- The Nigeria Revenue Service (Establishment) Act

- The Joint Tax Board (Establishment) Act

These Acts are intended to streamline tax collection, enhance compliance, and improve transparency across Nigeria’s tax system.

The Netherlands, one of Nigeria’s long-standing trade and investment partners, is the first foreign government to formally enter discussions to update its DTA with Nigeria under the new legal framework. The talks aim to eliminate outdated provisions, particularly those relating to double taxation, which have posed challenges to cross-border trade and investment.

Dr. Adedeji welcomed the initiative, stressing its importance in building mutually beneficial tax arrangements and aligning Nigeria’s international tax treaties with global best practices.