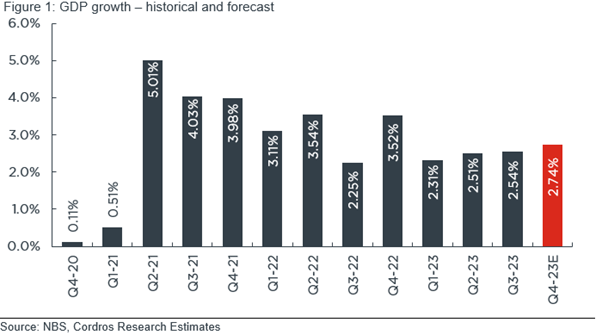

In the face of challenges posed by high production costs induced by foreign exchange (FX) devaluation, Nigeria’s economy sustained its positive growth trend for the third consecutive quarter in Q3-23 according to its GDP report released by the National Bureau of Statistics (NBS).

The report revealed a 2.54% year-on-year growth, a slight uptick from the previous quarter’s 2.51%. The oil sector, a critical component of Nigeria’s economy, displayed signs of improvement in Q3-23, growing by 0.85% year-on-year after enduring a significant contraction of 13.43% in the previous quarter.

The government’s efforts to combat oil theft and vandalism contributed to a 20.8% year-on-year increase in crude oil production, reaching 1.45 million barrels per day. However, challenges such as crude oil theft, pipeline vandalism, flow station shutdowns for repairs, terminal maintenance, and flare management, as well as inadequate contributions from licensed Oil Marginal Fields, persist, keeping the sector below pre-pandemic levels.

In contrast, the non-oil sector experienced a slowdown in growth momentum, expanding at a slower pace of 2.75% year-on-year in Q3-23 compared to the previous quarter’s 3.58%. Currency pressures during the period impacted the sector, particularly affecting the ICT, Trade, and Real Estate sub-sectors. The Finance and Insurance sub-sector, however, stood out with a robust growth of 28.21% year-on-year, supported by increased credit creation triggered by FX liberalization.

The Services sector’s GDP growth settled at 3.99% year-on-year, undermined by slower growth in ICT, Trade, and Real Estate. Meanwhile, the Manufacturing sector recorded slower growth at 0.48% year-on-year due to heightened production costs stemming from rising energy costs and currency pressures. The Agriculture sector grew by 1.30% year-on-year, facing challenges such as persistent insecurity in the food-producing belt, higher input costs, and rainfall deficit.

Looking ahead to Q4-23, analysts are cautiously optimistic about the economic outlook. The expectation is that the oil sector will return to positive territory, with an anticipated crude oil production of 1.41 million barrels per day, translating to a growth of 14.93% year-on-year.

The non-oil sector is also expected to rebound, expanding by 2.19% year-on-year, supported by growth in the Service, Manufacturing, and Agriculture sectors. Overall, the forecast suggests a 2.74% year-on-year growth in Q4-23, leading to a revision of the 2023 growth forecast to 2.54% year-on-year, down from the previous estimate of 2.92% year-on-year.