The Chairman of the Presidential Fiscal Policy and Tax Reforms Committee, Mr. Taiwo Oyedele, has projected that Nigerian states could collectively earn more than N4 trillion annually beginning in 2026, following the implementation of new Value Added Tax (VAT) reforms.

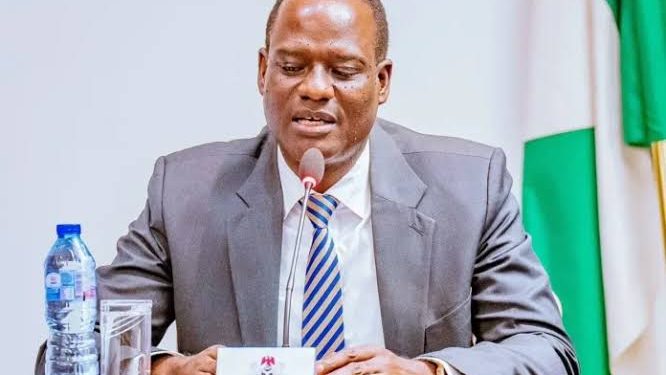

Oyedele made this known on Tuesday in Abuja while delivering the keynote address at the launch of the BudgIT State of States 2025 Report, an event that also marked the initiative’s 10th anniversary.

According to him, the VAT reforms will increase the share of VAT revenue allocated to states to 55 per cent, significantly boosting their fiscal capacity.

“With VAT reforms kicking in from 2026, states’ share will rise to 55 per cent. That could amount to over N4 trillion in 2026. The question is: will this money be spent or will it be invested?” Oyedele said.

He observed that while government revenues have increased—evidenced by the rise in Federation Account Allocation Committee (FAAC) disbursements from N5.4tn in 2023 to N11.4tn in 2024—many Nigerians have not felt corresponding relief, as household disposable income continues to decline.

He urged state governments to ensure that increased revenues translate into improved living conditions, warning that financial abundance without strategic planning could lead to waste.

The BudgIT report revealed that 21 states still depend on federal allocations for over 70% of their revenue, a situation Oyedele described as unhealthy. However, he highlighted positive examples such as Enugu, which recorded 381% growth in internally generated revenue, and Bayelsa, which achieved 174% growth.

He also pointed out that the transfer of electronic money transfer levies to states and tax exemptions on state-issued bonds would further reduce borrowing pressures and support fiscal sustainability.

Despite an improvement in capital spending, Oyedele noted gaps in implementation:

- States spent less than N7,000 per citizen on education

- Less than N3,500 per citizen on healthcare

- Over N1.2 trillion remains owed to pensioners, contractors, and workers

“Borrowing is not the problem; unproductive application of debt is,” he cautioned.

In the 2025 fiscal performance rankings, Anambra State topped the chart, followed by Lagos, Kwara, Abia, and Edo. Cross River however dropped sharply from 5th place in 2024 to 29th in 2025.

Also speaking at the event, the Deputy Governor of the Central Bank of Nigeria in charge of Economic Policy, Dr. Muhammad Abdullahi, urged states to maintain fiscal discipline as revenues increase.

He noted that transparency and digitisation of revenue systems would be essential to preventing waste.

The Nigerian Governors’ Forum, represented by Razaq Fatai, reiterated that the State of States report has become a vital accountability tool that continues to guide governance choices and encourage reforms across the country.

Co-founder of BudgIT, Oluseun Onigbinde, added that the report had empowered both citizens and leaders to track public spending and demand results.

“Every kobo meant for citizens should be traceable, justified, and used to improve lives,” Onigbinde said.