President Bola Tinubu has directed Nigeria’s financial and capital market regulators to closely monitor the growing use of stablecoins and digital currencies. He warned that the increasing shift away from traditional banking channels poses significant regulatory and economic challenges.

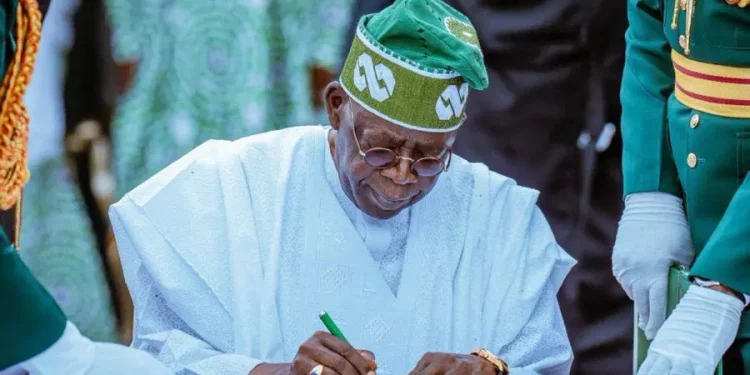

Tinubu, who was represented by the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, made this announcement during the 18th Annual Banking and Finance Conference of the Chartered Institute of Bankers of Nigeria (CIBN), held in Abuja on Tuesday.

“There is a digital revolution. So many people now are not using the banking system to make payments. They’ve turned to stablecoin. They’ve turned to digital currency,” President Tinubu stated.

He emphasized the need for Nigerian authorities to take control of the narrative before the evolution of digital finance systems becomes too advanced to regulate effectively.

The President’s directive comes at a time when the Securities and Exchange Commission (SEC) has intensified regulatory scrutiny of digital currencies. This follows the recent passage of the Investment and Securities Act 2025, which officially classifies digital assets as securities in Nigeria.

Analysts believe this move signals a more assertive stance by the government towards integrating fintech innovations into the national regulatory framework, while ensuring financial stability.