Consumer prices in the United States continued to show signs of moderation in September, with headline inflation dipping to 2.4% year-on-year, a slight decrease from August’s 2.5%. This trend, however, was above market expectations of 2.3%. The easing of inflationary pressures was primarily attributed to a significant decline in energy prices, which fell by 6.8% year-on-year, driven by lower gasoline and fuel oil costs.

Despite this overall decline, food prices reached an eight-month high, rising to 2.3% year-on-year from 2.1% in August. This increase was fueled by price pressures in both food away from home (up 3.9% year-on-year) and food at home (up 1.3% year-on-year). Additionally, core inflation rose to 3.3% year-on-year, up from 3.2% in August, reflecting a slower decline in used car and truck prices and a moderation in shelter costs.

On a month-on-month basis, headline inflation remained steady at 0.2%, the same as in August. While these figures provide some relief from price pressures, they remain above the Federal Reserve’s target of 2.0%.

Analysts suggest that persistent services inflation and core inflation may keep consumer prices elevated in the short term, leading to a cautious approach from the Federal Open Market Committee (FOMC) at their upcoming policy meeting. Current projections from the CME FedWatch tool indicate an 84.3% probability that the Fed will implement a 25 basis point cut in the key interest rate at the November 7 meeting.

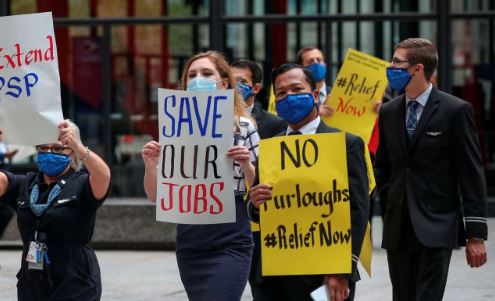

In a concerning development for the labor market, initial jobless claims surged by 33,000 to reach 258,000 for the week ending October 5, up from 225,000 the previous week.

This spike highlights a potential loss of momentum in the labor market and can be partly attributed to external factors including Hurricane Helene’s impact across several states and the Boeing machinist strike affecting the aerospace industry. Significant jobless claim increases were noted in Michigan, North Carolina, California, and Florida, while Louisiana and Massachusetts saw slight declines.

The four-week moving average for initial jobless claims also rose, increasing by 6,750 to 231,000. Looking ahead, analysts expect labor market conditions to remain soft, particularly in states affected by the hurricane and the strike.

However, they believe the FOMC may overlook these temporary disruptions and focus on the broader economic landscape, aligning with the Fed chair’s recent indications of a possible 25 basis point cut at the next meeting.