At the end of trading at the Nation’s Capital Market last week, the NGX All-Share Index and Market Capitalization appreciated by 2.13% to close the week at 54,949.21 and N29.934 trillion respectively.

Similarly, all other indices finished higher with the exception of NGX Sovereign Bond index which depreciated by 0.07%, while the NGX Insurance and NGX ASeM indices closed flat.

A total turnover of 799.848 million shares worth N29.354 billion in 14,194 deals was traded this week by investors on the floor of the Exchange, in contrast to a total of 751.990 million shares valued at N20.575 billion that exchanged hands last week in 15,822 deals.

The Financial Services Industry (measured by volume) led the activity chart with 480.122 million shares valued at N6.129 billion traded in 6,319 deals; thus contributing 60.03% and 20.88% to the total equity turnover volume and value respectively.

The Utilities Industry followed with 126.882 million shares worth N12.940 billion in 289 deals. The third place was the ICT Industry, with a turnover of 54.012 million shares worth N5.930 billion in 1,575 deals.

Trading in the top three equities namely Geregu Power Plc, Guaranty Trust Holding Company Plc and Zenith Bank Plc. (measured by volume) accounted for 307.755 million shares worth N17.489 billion in 2,325 deals, contributing 38.48% and 59.58% to the total equity turnover volume and value respectively.

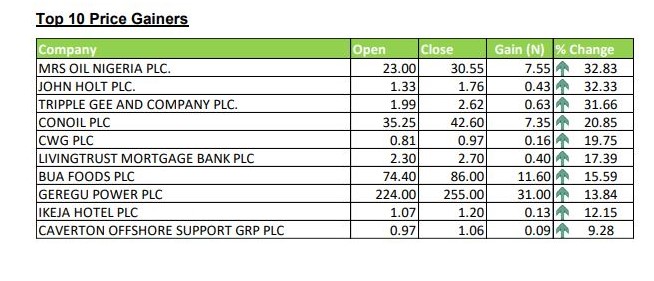

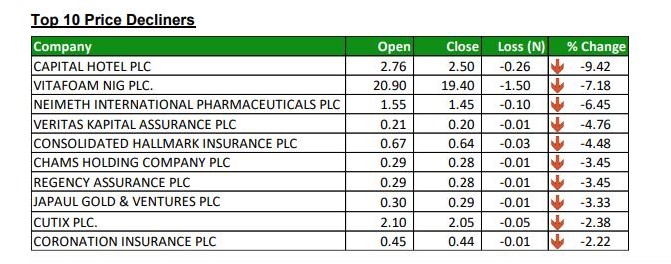

Thirty-nine (39) equities appreciated in price during the week higher than thirty-six (36) equities in the previous week. Twenty-two (22) equities depreciated in price lower than twenty-seven (27) in the previous week, while ninety-six (96) equities remained unchanged, higher than ninety-four (94) equities recorded in the previous week.

Global Economy

Meanwhile, the United States’ (US) private sector activity gathered momentum in February after seven months of decline. According to the flash estimates from S&P Global, the US Composite PMI (50.2 points vs January: 46.8 points) settled at an 8-month high in February, primarily driven by business activity, while factory activity continues to reflect a decline in production.

The Services PMI rose to 50.5 points (January: 46.8 points) – its highest print since June 2022 (52.7 points). Nonetheless, survey respondents highlighted customer hesitancy following hikes in interest rates and inflation. Elsewhere, the manufacturing PMI (47.8 points vs February: 46.9 points) remained depressed, primarily due to weak customer demand as new orders fell sharply in the review period.

While the factory activity remains in contraction, the accelerating business activity likely underscores how the upward driving force on inflation has now shifted to wages amid the resilient labour market. Hence, the US Fed could likely keep rates higher for longer, subduing the nascent overall expansion.

According to the flash estimates from S&P Global/CIPS, the UK’s overall private sector activity as measured by the Composite PMI rose above the 50-point no-change mark in February after six consecutive months of being in the contractionary territory.

The Composite PMI settled higher at 53.0 points in February (January: 48.5 points), given the increased consumer demand and improving business confidence in line with the slowdown in inflationary pressures and lower economic uncertainty. Consequently, the Services PMI (53.3 points vs January: 48.7 points) returned to growth, in line with the more robust demand for business services amid an improving global economic outlook and reduced domestic political uncertainty. At the same time, the Manufacturing PMI (49.2 points vs January: 47.0 points) settled at a 7-month high, given the recovering demand.

While the economy continues to face headwinds from rising interest rates and labour shortages, we understand that the broader business mood has been buoyed by (1) signs of peaking inflation, (2) improving supply chain, and (3) recession risks easing. Accordingly, the resilient economy and sticky inflationary pressures could prompt the Bank of England (BOE) to tighten the policy rate further.

Global Markets

Interest rates concerns remained in the driver’s seat for the global equities markets this week as investors digested minutes of the Federal Reserve’s meeting and the Personal Consumption Expenditures Price (PCE) data for further Fed actions.

Accordingly, US equities (DJIA: -2.0%; S&P 500: -1.6%) retreated as the focus remained on the Fed’s comments on interest-rate outlook. Similarly, European equities (STOXX Europe: -0.4%; FTSE 100: -1.2%) wavered as investors digested the latest Federal Reserve minutes and Eurozone inflation data (January 2023: -60bps to 8.6%).

Meanwhile, mixed sentiments dominated the Asian markets. Chinese equities (SSE: +1.3%) posted gains following mixed signals in corporate earnings from Chinese big tech companies (Alibaba and Techtronic), while the Japanese equities (Nikkei 225: -0.2%) declined, taking a cue from the selloffs on Wall Street. Likewise, the Emerging (MSCI EM: -1.2%) and Frontier (MSCI FM: -1.2%) market indices mirrored the bearish sentiments across global equities consequent upon losses in South Korea (-1.1%) and Vietnam (-1.5%), respectively.