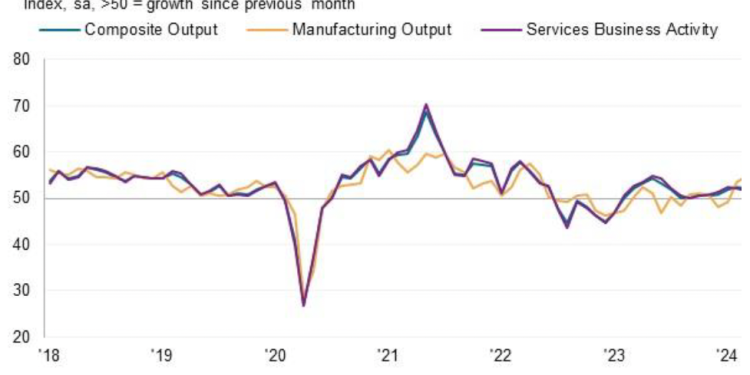

In the United States, private sector activity showed signs of softening in March, as indicated by flash estimates from S&P Global. The US Services Purchasing Managers’ Index (PMI) settled at 51.7 points, down from February’s 52.3 points, while the Manufacturing PMI moderated to 51.9 points compared to 52.2 points in the previous month. This decline was attributed to persistent cost pressures and weak external demand.

Despite the challenges, both indices remained above the crucial 50-point threshold for the fourteenth consecutive month, signaling continued expansion, albeit at a slower pace. Analysts noted that businesses continued to grapple with rising prices and subdued demand, particularly in the face of prolonged high interest rates set by the US Federal Reserve.

Factory activity, in particular, felt the impact of increasing labor costs and higher energy prices. However, it maintained resilience for the third consecutive month, underscoring the sector’s ability to navigate through challenges.

The Composite PMI, which provides an overall snapshot of private sector activity, settled at 52.2 points in March, slightly lower than February’s 52.5 points. This reflected a weakened expansion rate across private sector firms, although still indicative of growth.

Analysts anticipate that private business activity in the US will continue to expand in the short term, supported by improved business confidence and signs of broader economic recovery. However, they caution that the higher living costs stemming from elevated energy prices pose a downside risk to these expectations.

Despite the challenges, the overall outlook remains positive, with businesses expected to adapt and innovate to sustain growth amid evolving economic conditions.