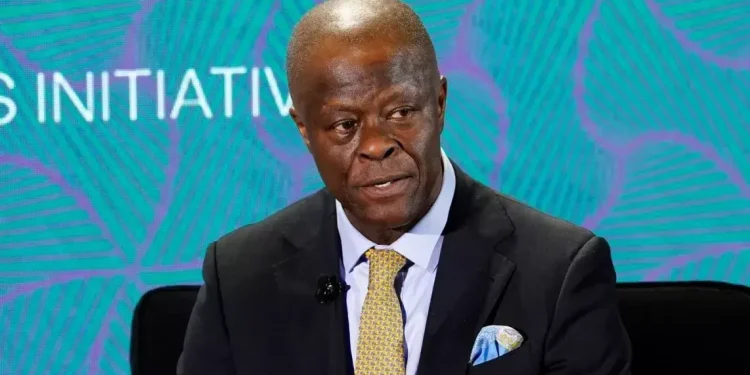

The Minister of Finance and Coordinating Minister for the Economy, Mr Wale Edun, has assured stockbrokers and investors that the government’s review of the Capital Gains Tax (CGT) policy will serve the best interests of Nigeria and Nigerians.

Edun gave the reassurance on Tuesday during the Closing Gong Ceremony at the Nigerian Exchange (NGX) to mark the listing of the Ministry of Finance Incorporated (MOFI) Real Estate Investment Fund Series 2.

Stakeholders in the capital market had earlier voiced concerns that the new Capital Gains Tax regime, scheduled to take effect in January 2026, could discourage foreign investment and reduce trading activity in the Nigerian equity market.

The Capital Gains Tax applies to profits realised from the sale or disposal of shares and other equity instruments. Under the new framework, investors who profit from rising share prices are expected to contribute a portion of their gains to public revenue.

Under the revised structure, the CGT rate has been increased from 10 per cent to 30 per cent for large companies, while individual investors will be taxed based on their applicable personal income tax rate under the progressive tax band.

Edun, however, stressed that the government remains sensitive to market realities and is working closely with stakeholders to ensure that the implementation of the tax reform strengthens, rather than weakens, investor confidence.

“The engagement on the capital gains tax is ongoing, and the outcome will be in the interest of Nigeria and Nigerians,” the Minister assured.

He added that the Federal Government’s overall goal is to enhance fiscal transparency, mobilise revenue responsibly, and stimulate sustainable economic growth without disrupting market stability.

Market analysts have welcomed Edun’s assurance, saying the dialogue between policymakers and capital market operators is critical to ensuring that reforms do not undermine liquidity, innovation, or investor sentiment in the Nigerian Exchange.