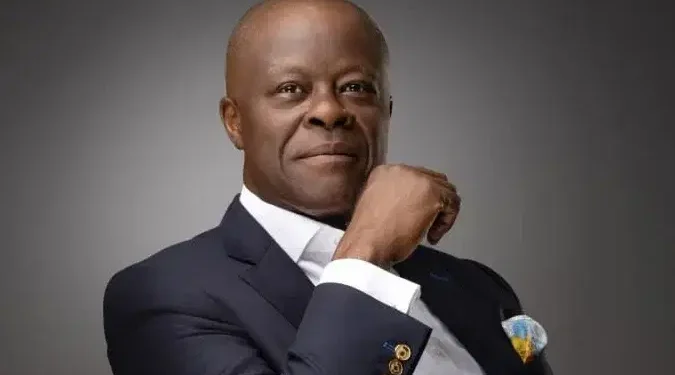

Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, has reiterated the importance of a trusted and stable financial system in achieving Nigeria’s ambitious goal of transitioning into a $1 trillion economy.

Speaking over the weekend in Abuja during the inauguration of the new board of directors of the Nigerian Deposit Insurance Corporation (NDIC), Edun emphasized that institutions like the NDIC are critical in ensuring public confidence and supporting the country’s macroeconomic reform agenda.

“Domestic savings are the engine of sustainable investment,” the minister stated.

“A trusted and stable financial system, anchored by institutions like the NDIC, is essential to lifting millions out of poverty and driving Nigeria’s transition to a $1 trillion economy.”

The newly inaugurated NDIC board is led by Managing Director, Dr. Thompson Olu Dare Sunday, and Executive Director, Dr. Ibrahim Sabokatata, both appointed by President Bola Ahmed Tinubu. The board is tasked with reinforcing financial stability, deepening public trust in the banking sector, and aligning its operations with the broader objectives of the Renewed Hope Agenda.

The NDIC plays a vital role in protecting depositors, ensuring the soundness of Nigeria’s banking system, and promoting savings culture among Nigerians—factors considered essential for long-term economic growth and financial inclusion.

The minister’s remarks reinforce the government’s commitment to economic transformation, with a focus on strengthening domestic investment, safeguarding financial institutions, and building a more resilient financial ecosystem.