Rising gasoline prices have continued to exert upward pressures on consumer prices in the United States (U.S.). According to the U.S. Bureau of Labour Statistics, headline inflation increased by 0.6% in March the highest since August 2012.

This increase was primarily attributed to the price increase in the gasoline index (+9.1% m/m vs February: +6.4% m/m), which accounted for c.49.0% of the seasonally adjusted increase in the headline inflation.

Meanwhile, food prices (+0.1% m/m vs February: +0.2% m/m) rose at a slower pace, with the food at home index and the food away from home index growing by 0.1% m/m. On a year-on-year basis, the headline inflation grew by 90bps to 2.6% – the highest reading since August 2018 (+2.7% y/y) on account of a low base effect and improvement in economic activity.

Experts at Cordros say the improvement in economic activities will slowly drive inflation higher on a m/m basis, and that the low base effect from the prior year to continue to stoke higher y/y readings.

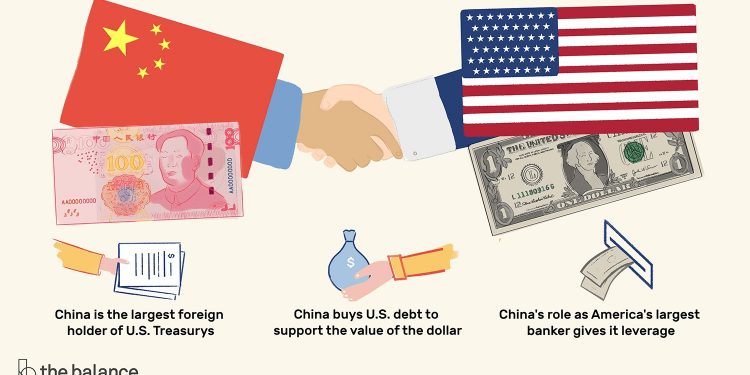

CHINA

According to the Chinese National Bureau of Statistics (NBS), China’s economy grew by 18.3% y/y in Q1-21 – the highest since the NBS started keeping a year-on-year growth record in 1993. For us, the growth was bolstered by (1) solid industrial output, (2) robust export growth given the demand for China-made medical goods and (3) low base effect, and (4) rebound in consumer spending following the re-opening of the economy after the global lockdown.

On a quarter-on-quarter basis, economy Watchers say that the economy grew marginally by 0.6% in Q1-21 (Q4-20: +3.2% q/q) largely due to travel restrictions in place over the Lunar New Year holiday amid the increase in new COVID-19 cases.

A favorable base from Q1-20 contributed more to the positive outturn in Q1-21 even as export and industrial production increased at a moderate pace. Looking ahead, we expect the magnitude of expansion in GDP to moderate as the impact of the low base effect begins to dissipate. [Courtesy Cordros Capital]